In today’s monetary landscape, managing your credit and sustaining a constructive history may be difficult. For numerous reasons, individuals may discover themselves delinquent on loans, making it difficult to safe further borrowing opportunities. This guide aims to shed gentle on how one can still entry loans if you have been marked as delinquent up to now.

What Are Loans for Delinquent Borrowers?

Loans for delinquent debtors are specialized financial merchandise designed to cater to people who have had difficulties in meeting earlier loan obligations. These can include missed funds, defaults, or different credit points that have led to a decrease credit score score. The major purpose is to offer monetary aid and help restore creditworthiness.

Who Qualifies as a Delinquent Borrower?

A delinquent borrower is typically somebody who has missed one or more loan funds. The exact definitions may vary depending on the lender and the kind of mortgage, however the general rule of thumb is that any missed fee past a sure period (usually 30 days) qualifies you as delinquent. It’s essential to understand the place you stand before trying to secure one other loan.

Types of Loans Available

Several mortgage sorts can be found for those with delinquent records, together with:

- Secured Loans: These require collateral similar to a car or property. The lender has a decrease danger due to the collateral, often making it simpler to secure the mortgage even with delinquencies.

- Unsecured Loans: These do not require collateral however usually have larger interest rates. Lenders offset the increased danger with larger returns.

- Payday Loans: Short-term, high-interest loans meant to cover instant expenses till the next paycheck.

- Peer-to-Peer Loans: Funded by particular person investors rather than banks, these loans usually have extra flexible terms and situations.

How to Improve Your Chances of Getting Approved

Securing a mortgage when you may have a delinquent document may be challenging however not unimaginable. Here are some strategies:

Build or Improve Your Credit Score

Take energetic steps to improve your credit score score, corresponding to paying off excellent debts and avoiding new delinquencies. Regular checks on your credit score report assist you to understand the place you need improvement. Visit Wikipedia to be taught more about what influences your credit rating.

Provide Collateral

Offering collateral decreases the risk for the lender and may significantly improve your probabilities of approval. Ensure that the asset you present as collateral is effective sufficient to cover the mortgage amount.

Get a Co-Signer

A co-signer who has good credit score can also assist you to safe a loan. The co-signer is responsible for paying the debt should you default, giving the lender extra assurance.

Alternatives to Traditional Loans

If traditional loans are onerous to return by, consider these alternate options:

Credit Unions

Credit unions typically have extra lenient standards and should provide loans tailored for those with poor credit. They focus extra in your overall monetary well being than strict credit score scores.

Community-Based Programs

Many native communities offer financial help programs geared toward helping residents in monetary misery. These packages can provide funds with lower interest rates and more lenient compensation phrases.

Grants

For certain conditions, corresponding to particular academic or health wants, grants could be obtainable. Unlike loans, grants do not must be repaid.

The Risks Involved

While these loans is usually a lifeline, they arrive with their own set of risks:

High-Interest Rates

Most loans for delinquent debtors come with high-interest rates due to the increased threat for lenders. Ensure you probably can accommodate these larger repayments before committing.

Shorter Repayment Terms

Some lenders might provide shorter repayment phrases, which means you will be required to make bigger monthly payments. Again, guarantee this fits into your price range.

Credit Impact

If you default on these loans, it could further injury your credit score score, making future borrowing even more tough. It's important to have a transparent compensation plan before you are taking out such a loan.

Steps to Take After Securing a Loan

Once you have secured a mortgage, comply with these steps to make sure you can manage it successfully:

Set Up Automatic Payments

Automating your payments ensures you by no means miss due dates, which is crucial for bettering your credit score rating. Make sure you at all times have enough funds in your account to cowl payments.

Budgeting

Create Day Laborer Loans a realistic and manageable finances Home page to ensure you could meet your mortgage funds while overlaying other important residing expenses. Use instruments and apps like budgeting apps that will help you keep organized.

Where to Find More Information

For these looking to dive deeper into the topic of loans for delinquent borrowers, check out resources such more info as Wikipedia or monetary advice web sites like Yahoo Finance and Bing.

Understanding loans for delinquent borrowers is essential for anyone with a troubled financial past. By knowing the forms of loans out there, improving your credit score score, providing collateral, using co-signers, exploring alternate options to traditional loans, and being aware of the risks involved, you possibly can navigate your approach to monetary stability. For more detailed information, go to this website.

Kel Mitchell Then & Now!

Kel Mitchell Then & Now! Kelly McGillis Then & Now!

Kelly McGillis Then & Now! Barry Watson Then & Now!

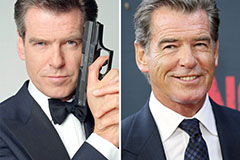

Barry Watson Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! Nicholle Tom Then & Now!

Nicholle Tom Then & Now!